Please refer to our Customer Relationship Statement and Form ADV Wrap program disclosure available at the SEC's investment adviser public information website: CARBON COLLECTIVE INVESTING, LCC - Investment Adviser Firm (sec.gov).

CAPITAL ASSET PRICING MODEL EQUATION REGISTRATION

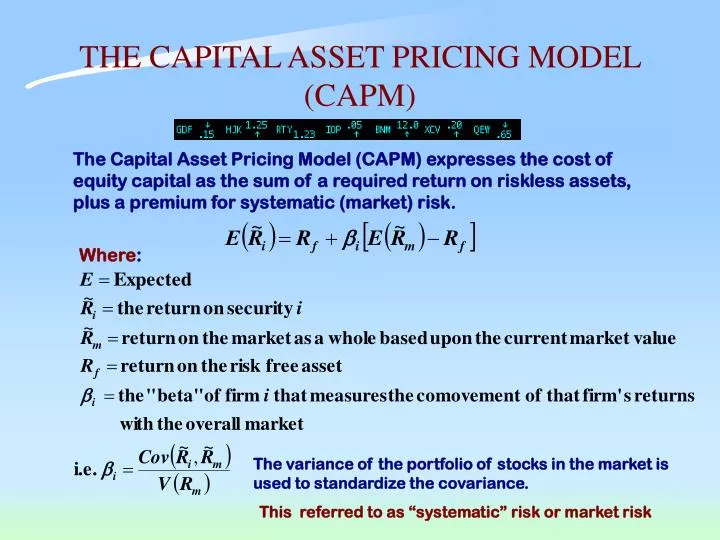

Registration with the SEC does not imply a certain level of skill or training. Like all valuation models, CAPM has its limitations since some assumptions it uses are idealistic.įor example, Beta coefficients are unpredictable, change over time, only reflect systemic risk rather than total risk.ĭespite its shortcomings, this model is very popular for valuing securities.Ĭontent sponsored by Carbon Collective Investing, LCC, a registered investment adviser. If a security is found to have a higher return relative to the additional risk incurred, then the CAPM model suggests that it is a buying opportunity. In layman's terms, the CAPM formula is: Expected return of the investment = the risk-free rate + the beta (or risk) of the investment * the expected return on the market - the risk free rate (the difference between the two is the market risk premium).įor each additional increment of risk incurred, the expected return should proportionately increase.

To calculate the value of a stock using CAPM, multiply the volatility, known as " beta," by the additional compensation for incurring risk, known as the "Market Risk Premium," then add the risk-free rate to that value. The Capital Asset Pricing Model, or CAPM, calculates the value of a security based on the expected return relative to the risk investors incur by investing in that security.

Capital Asset Pricing Model (CAPM) Overview

0 kommentar(er)

0 kommentar(er)